A quick and easy way to verify customer information in under 60 seconds. Simplify the verification of your customers and ensure the compliance of your onboarding procedure.

.svg)

.svg)

Make sure you comply with international regulations (KYB, AML) with automated verification.

Intuitive interface and detailed reports for quick and easy verification, even for non-specialized teams.

Automated verification to save time & resources, by reducing errors.

Early detection of risks through real-time monitoring, increasing transaction security.

Real-time access to sanctions lists, PEPs and asset freezes, with continuous monitoring.

Accurate assessment of financial health to improve the reliability of information and business decisions.

Dataleon integrates easily with your existing systems, ensuring rapid adoption without disrupting your operations. Thanks to our flexible and modular solutions, benefit from a simple and effective implementation to improve the performance and security of your business from day one.

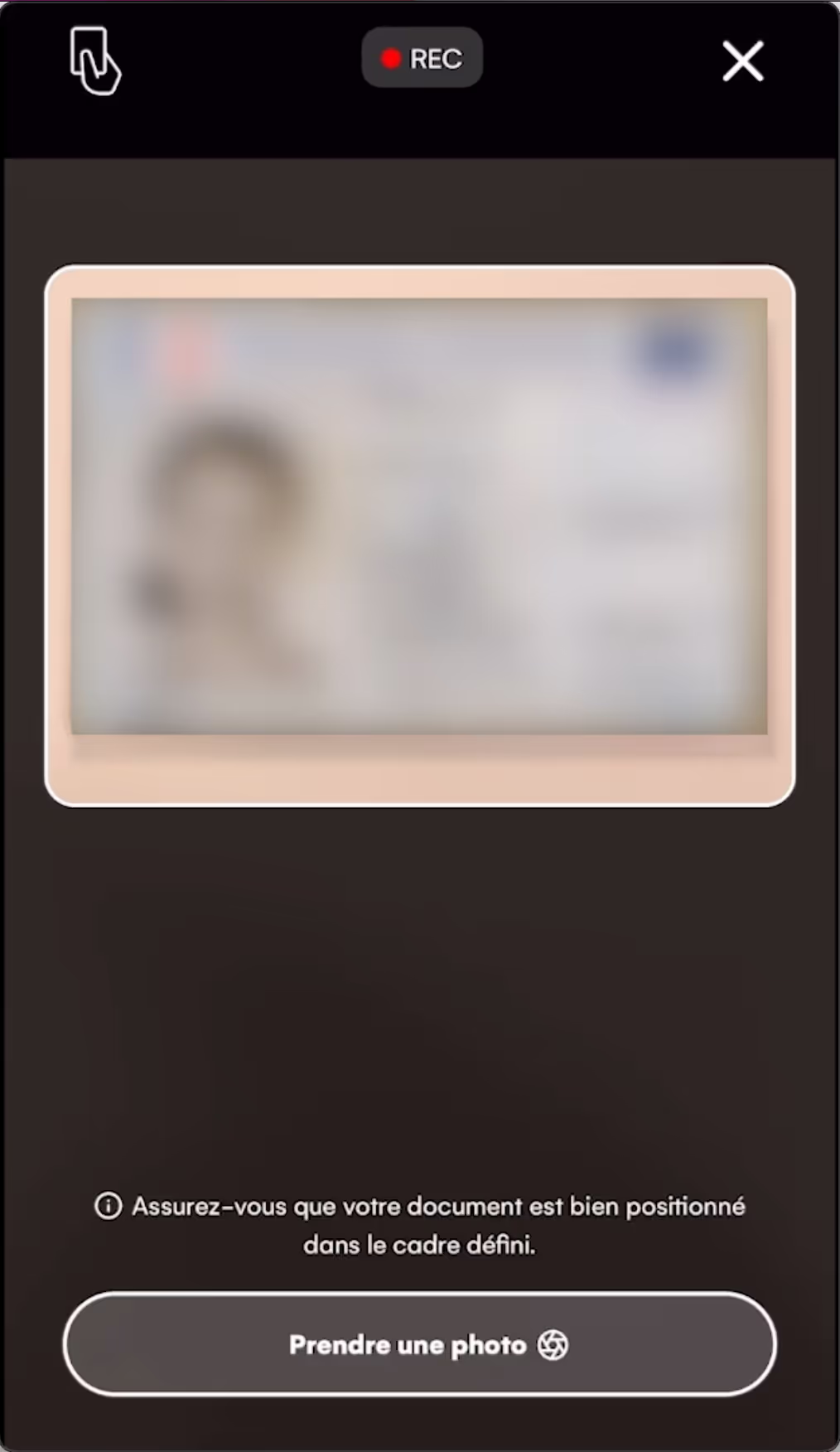

Same operation with KYB and KYC solutions (above example with the KYC webview).

Integrate the solution directly into your onboarding journey via a smooth and transparent webview for the user.

Fast integration

Seamless user experience

Customization made easy

Dataleon offers flexible solutions tailored to your unique challenges. Whether it's for compliance, process optimization or cost reduction, we guarantee you concrete and measurable results.

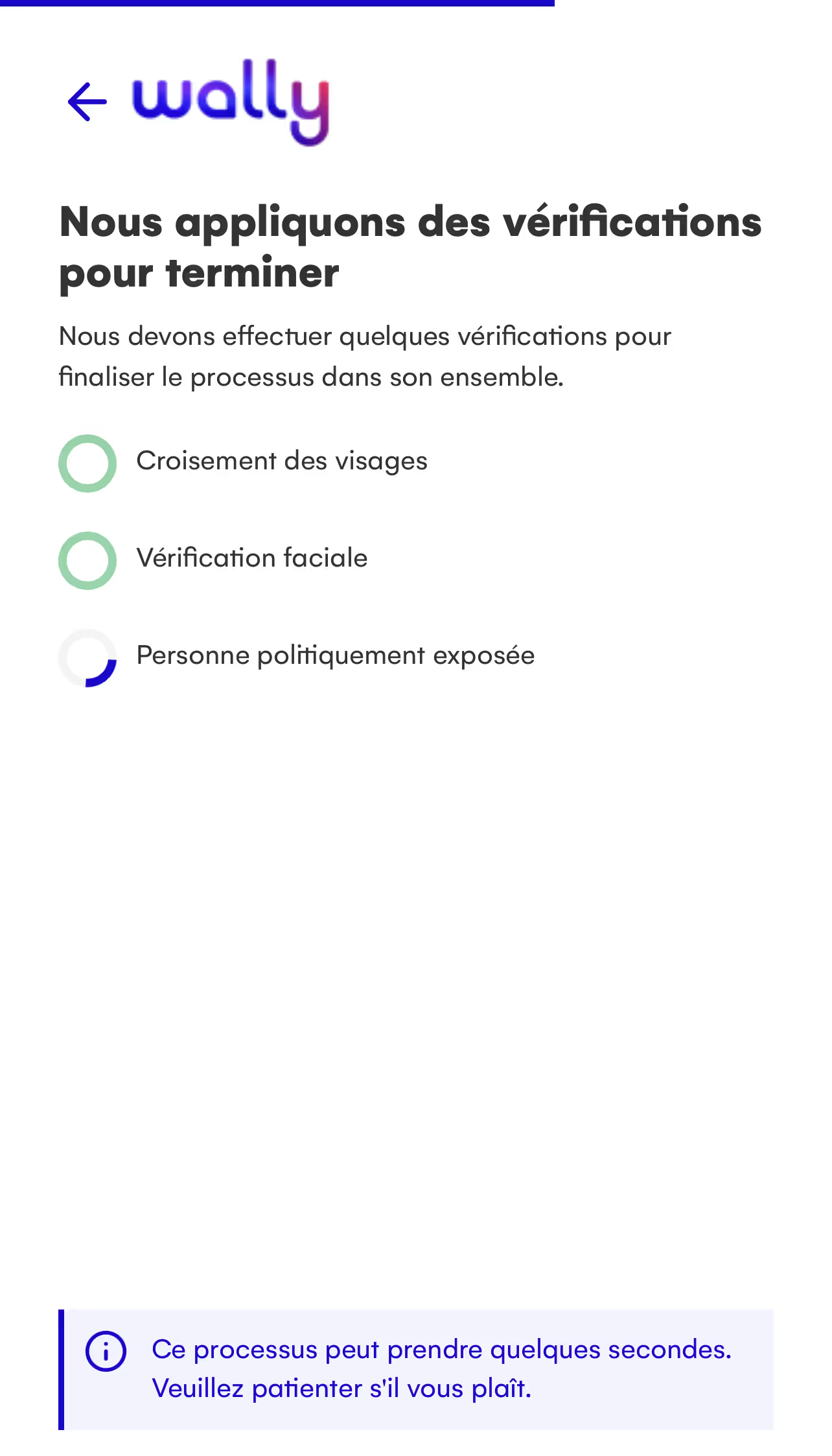

Turnkey portal

No integration required

Accountancy

Same operation with KYB and KYC solutions (above example with the KYB portal).

Dataleon adapts to your processes: our solutions are compatible with a wide range of tools for simple and seamless synchronization.

.avif)

Make an appointment below and we will get back to you as soon as possible to understand the KYC API

Our KYC solution is powered by artificial intelligence trained on more than 3,000 types of official documents, covering passports, identity cards, driving licenses... from more than 190 countries, guaranteeing reliable and global verification.

We integrate our solution with your white label onboarding platform to automate identity verification.

Validate the identity of your customers in 1 minute thanks to our guided and secure process. Our solution allows you to simplify the authentication process, which not only improves security, but also the experience of your customers, ensuring quick and effective verification in 4 simple steps.

Selecting the type and country for the identity document

.avif)

Photographing the identity document front and back

Confirmation of identity with an AI-assisted selfie in image or video

Real-time control of data provided by the user

Instantly validate the identity of your customers with our AI, for secure, reliable verifications that improve the user experience.

Our KYC solution ensures total compliance (LCB-FT, PVID in progress).

AI detects falsifications and prevents identity theft for essential security.

Automate KYC, reduce costs, and accelerate onboarding effortlessly.

Our KYC solution covers over 200 countries and regions, giving you fast and compliant identity verification no matter where your users are located.

et conforme, où que se trouvent vos utilisateurs.

Our KYC solution meets a variety of identity verification and compliance needs. Whether it is to prevent fraud, ensure the integrity of transactions or ensure compliance with regulations, our technology offers fast and secure verification adapted to each sector, thus strengthening risk management while optimizing the user experience.

Automate and secure identity verification with our AI-based KYC technology. Accelerate your processes, reduce risks, and get accurate results in seconds.

Your KYC documents are convertible into structured data in less than 10 seconds. Get the results in real time.10 seconds thanks to our instant KYC document conversion.

Our technology is trained to extract data from KYC, Latin and European language documents.

We integrate sanctions lists and PPE to protect your data against fraud and non-compliance.

Thanks to 3 years of AI research, our solution allows you to guarantee 95% accuracy for strong automation for the management of your KYC documents.

Dataleon is GDPR compliant and offers a highly secure environment for each customer through regular audits of its technical infrastructure by third-party cybersecurity companies.

We are ISO 27001 certified and offer a highly secure environment to our customers. Daily penetration tests and regular security audits of our infrastructure guarantee the integrity of your data.

Our KYC API is available to any user with an account on our platform and includes a free test period. To test our APIs, all you need to do is create a free account, and you can download KYC documents in our user interface to see the KYC API in action, as well as the json output.

The KYC API has been formed with invoices from over 10 document types and 20 EU countries, ensuring that you can extract data from your KYC documents regardless of where they were created. Our KYC API is based on our computer vision technology that doesn't rely on text to extract data, but not just on the image.

The processing time is approximately 3 seconds per page of KYC documents. We often improve this processing time on KYC documents and our goal is under 1 s. With large volumes and batches of large KYC documents, you can use asynchronous mode for higher availability.

Dataleon offers support to its users, with a dedicated team of machine learning engineers based in Paris, available from 9 a.m. to 6 p.m. CET. For support requests outside these hours, please send us an email and one of our engineers will respond as soon as possible. Contact our support team at support@dataleon.ai for assistance.

Yes, your KYC documents are removed. When processing your document or image, we create a temporary server. After processing, your KYC document and container are removed. Your data is no longer accessible, not even by Dataleon.

Dataleon allowed us to save 4 times more time in deploying our solution, thanks to their automation and no-code solution with artificial intelligence.

Dataleon's financial data conversion solution allowed us to save time for our technical teams while allowing us to offer other services to our customers.

The scalable solution of the Dataleon platform allows our teams to focus on tasks with high added value and thus improve the onboarding of our customers.

Thanks to the Dataleon solution, and their AI engine and excellent support, we were able to implement data processing in less than 3 days.

Dataleon can help you bring your images and documents to life with ease.

Test the platform for freeContact us.svg)

Try 15 days

.svg)

No credit card

.svg)

Cancel Anytime